Happy Thursday!

I assumed after one month of writing into the void, my readers would be comprised of a few colleagues and my mom (who I believe reads these articles to help her fall asleep at night) - but have found, instead, there are a lot of you who think and care about this stuff just as much as my colleagues and I do.

The world of subscription pricing is small but appears to be growing quite fast. I remember when I started working at Price Intelligently in ‘17, I'd get asked frequently what “monetization” meant. Now, it’s rare to see companies that don’t have a leader dedicated to pricing & packaging.

Anyway, It’s been a very cool month; appreciate you all joining me on the journey to better understand and unpack the mysteries of subscription pricing.

Since we last caught up on May 4th, I had 28 pricing discussions and was asked about…

Usage-based Pricing ⇒ 1 time

Hybrid Pricing ⇒ 4 times

Product Bundling ⇒ 6 times (!)

Discounting ⇒ 3 times

Freemium ⇒ 2 times

Packaging ⇒ 8 times

Increasing Prices ⇒ 5 times

Localization ⇒ 4 times

The weather ⇒ ~20 times (it’s spring, huh?)

As a side note, I’m thinking about aggregating these categorical sets of questions on a quarterly basis. The goal would be to put a bit more statistical rigor behind the trends I’m seeing and track changes over time. If that’d be useful for you, just respond to this email or comment below and I’ll hook you up with it once finalized.

Today, we’re going to talk about how many tiers your SaaS product should have.

In the ~1,500 hours of pricing conversations I’ve been a part of, there’s a short list of dilemmas I’ve heard noticeably above the rest. One of those dilemmas tends to go something like this:

“Jim in Product thinks we should opt for a simple landing page with two tiers. Pam in Marketing thinks we should build out 5 tiers based on what our competitors are doing. Settle this debate for us, will you?!”

To which I usually take a deep breath and attempt to articulate in 30 seconds what you are about to read. The solution at the heart of this debate is more nuanced than you might realize. So, let’s dive in.

The Goldilocks tiering method (e.g. “good, better, best”) was spun up long before the world of SaaS ever existed. Before we had Salesforce and HubSpot to copy, we had the automotive industry, airlines, and Starbucks leveraging multi-tiered pricing models designed to influence buyers through manipulative wizardry known as price anchoring.

The logic behind this phenomenon was (and still is) that buyers become anchored to the highest price point they see and are subsequently inspired to purchase a less-expensive counterpart (e.g. that first-class ticket to Orlando is it bit too pricey, but screw it, we can afford to ball out in Delta comfort for the kids!).

While this may sound like another cringey adage from your freshmen-year management class, it’s an approach that has proven pretty successful across a myriad of industries. So well, in fact, that when the SaaS boom of the early 2010s took place, many companies took note.

We started seeing an influx of companies adopting three-tiered models that looked like this:

…and a few opting for more tiers:

These types of models became synonymous with the SaaS ecosystem. And somewhere along the line the idea of price anchoring became so deeply embedded in SaaS pricing & packaging philosophy that folks started taking the path of least resistance, building strategies based on competitive benchmarking and gut feel.

For some, this worked. For many, it didn’t.

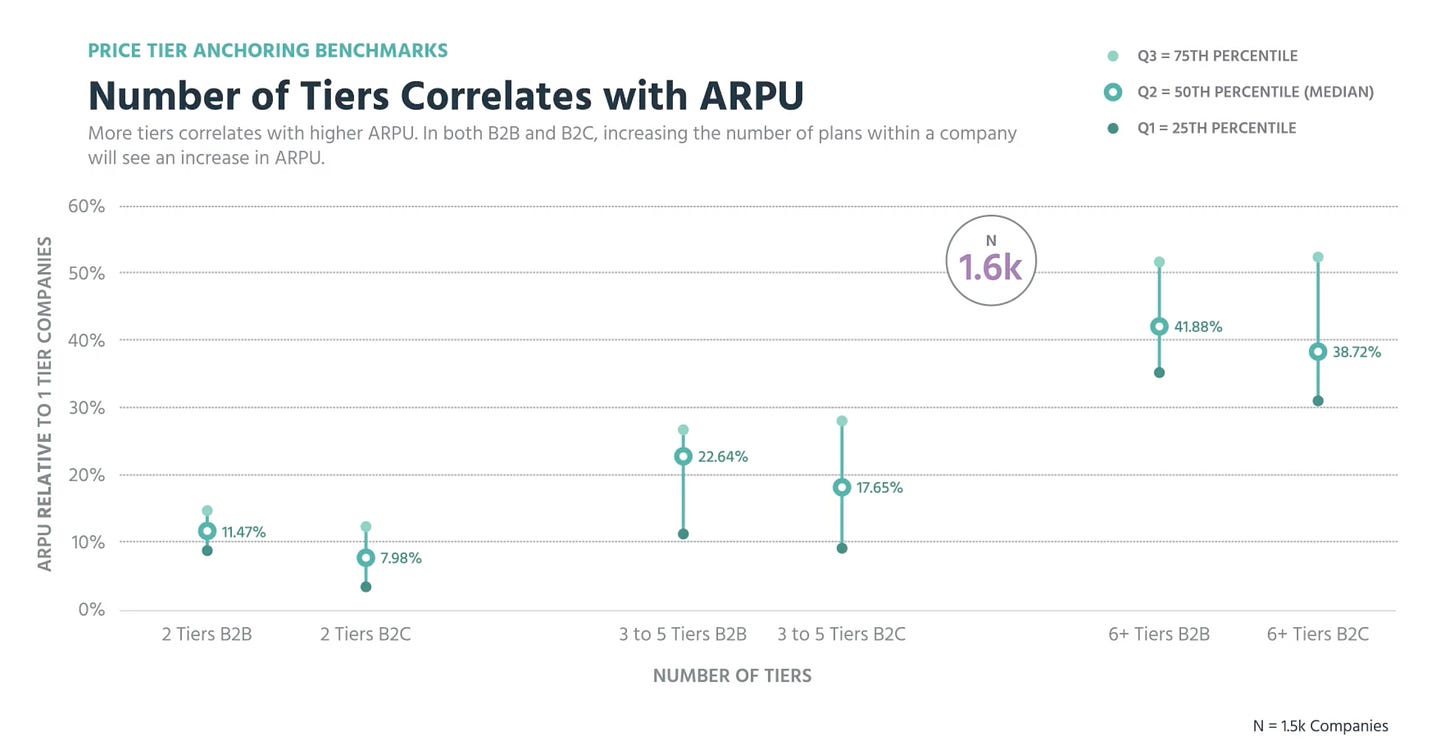

Today, we’re finding more and more SaaS companies are auditing the number of tiers their products have due to changing market dynamics, pressure from the board, breaking free from sins of their past, etc — to do so correctly, here are a few benchmarks I’d keep in your back pocket:

Despite what you might initially think, there isn’t a ton of variance in conversion rates when it comes to the number of tiers your product has.

Companies with two tiers tend to see similar conversion rates to those with seven.

Although companies with four to five tiers tend to see slightly higher conversion rates on average than those with six, we don’t see any conclusive evidence demonstrating a definitive approach across the board.

However, (and this is where things start to get interesting)…

…while conversions aren’t impacted by the number of tiers, ARPU is.

As the number of tiers increases, so too does ARPU.

So is Pam right? Should you just build out 5+ tiers on your website? Not exactly.

What’s missing from this data is where these tiers live. Not all of them should reside on your pricing page. In fact, opting for a persona-tailored pricing page that doesn’t cannibalize customer expansion paths is, in many ways, a great outcome.

Your pricing page should give each of your buyer personas a clear view of…

Whether your product solves their problem.

The version of your product that will become the antidote to their problem (i.e. which tier they should purchase).

A fair price predicated on their ascribed value.

The number of tiers on your page has less to do with landing page design and more to do with the number of buyer persona needs you’re aiming to satisfy. You can have the best-looking 4-tiered pricing page out there, but if you don’t truly understand what your buyers need and what they’re willing to pay, not much else matters.

Assuming your pricing page accomplishes these three components, let’s add another small layer of complexity. Price anchoring is a real thing.

In this study, we looked at two identical products and A/B tested two scenarios. We found buyers were ~10% more likely to purchase a $10 plan when the alternative was $20 vs. $15.

This means effective anchoring can increase conversions for a particular tier, which depending on the product, may be your primary goal (e.g. entry-level “land and expand” tiers — think Notion, Canva, Slack, etc).

Once you’ve converted your prospect into a customer, the next leg of your journey becomes maximizing your product’s expansionary revenue potential. As we saw above, companies with 7+ tiers see higher ARPU growth than companies with two. But again, not all of these tiers should live on your pricing page.

Consider this, some of your add-ons and upgrade paths should be presented to already paying customers.

This requires you do some research ahead of time — I’ll hold my tongue on a hip Boston-based team that could help with this — to understand which features, value metrics, value propositions, etc. get new users in the door vs. which become of value once they’ve used the product for a certain amount of time.

If you don’t have this data, start by digging into your product analytics tool (e.g. Amplitude, Mixpanel, Pendo, etc) and map product and value metric usage by cohorts of users. Then zoom out and find trends. For example, some features may be used religiously by 20-30% of your users after 6 months of using the product — these tend to be great add-on candidates.

Your optimal tiering structure has more to do with buyer psychology and the buyer journey than it does with landing page design.

But anyway, for those that just wanted the answer: you should probably have 2-4 tiers on your pricing page with an additional 3+ upgrade paths for existing users.

Or just let Jim & Pam arm-wrestle to figure it out. It’ll save you some time.

See you in 2 weeks!

-Evan

This is so interesting. Well done.

It would be interesting if we could stat some sort of 'pricing meme' indicator. Maybe use some basic AI to develop the categories and then count them by looking at pricing and packaging conversations on LinkedIn.