Happy Thursday,

I learned last week that there are now Notes From the Pricing Underground readers in 35 countries. The internet rocks. And thank you all for carving out some time for me every couple of weeks.

This is a slightly longer post than usual, so I’m going to skip the recap and get right down to it.

Today, we’re going to talk about the road to profitability.

Bessemer Venture Partners published their annual State of the Cloud Report earlier this year which was fascinating on a few fronts, though one study stuck out to me.

What you’re seeing here is the relative impact of revenue growth and profitability (free-cash-flow margin) on valuations.

In November 2021 (remember when interest rates were low and NFTs were being sold for $3m?), revenue growth was 6x more important than profitability.

Today, this ratio is down to 2:1.

In other words, the enterprise value of your company is much more closely linked to profitability today than it was 18 months ago.

Because of this, executive teams everywhere are searching for levers to improve margins more than they have in a long time. Gone are the days of 18x multiples in funding rounds. The game has shifted, and it is this shift that I’d like to explore.

Let’s unpack a series of strategic changes I’d classify as “low-hanging fruit”, segmented by varying degrees of effort and impact on profitability.

Low Effort | High Impact

Strategic changes we’re seeing yield a positive impact on profitability without requiring a great deal of cross-functional effort.

Increase/Decrease prices.

As a rule of thumb, you should not increase or decrease prices simply because you have an organizational responsibility to improve profitability. You should do so because of the changing value your buyers ascribe to your product — and further, because your pricing may be out of date in some capacity.

Remember, your customers don’t care about your costs or your KPIs. They buy your product(s) and ultimately stick around because they are able to ascribe and quantify value.

That said, one of the dirty secrets of the SaaS world is pricing changes happen far too infrequently. We make regular product adjustments, introduce new features, and increase the overall value of our products and only after a few years realize the gaping disparity between outdated prices and buyer value.

This mistake was admissible two years ago when growth metrics were driving enterprise valuation. Today, however, it is not.

If it’s been a few years since you increased prices, now’s the time to run some tests and affirm what you probably already know: the value ascribed to your product has changed. By not adjusting prices accordingly, you’re doing your team a disservice.

You may also discover an opportunity to decrease prices. We’ve worked with many PLG (product-led growth) companies aiming to increase free to paid conversions recently. In these cases, a decrease in entry-level prices has been a growing recommendation. By targeting a cohort of free users who may be willing to pay for your product but can’t justify the current jump to your paid tier(s), decreasing prices can have a great impact on profitability.

The real kicker here is continually creating expansion paths for customers. Once they make the jump from free to paid, their journey isn’t over. You should know the features and value metrics that will increase their expansionary potential over time.

The goal of PLG is not simply to get free users to become paying users but rather to map an ongoing purchasing path for customers that get an increasing amount of value from the product.

Stop discounting.

Easier said than done, I know. It’s harder to sell products above and below the line today than it has been in a long time. But let me highlight a few stats that paint the picture of what regular discounting is doing.

Aside from simply implying a devaluation of the product as we’ll unpack below, when your reps are discounting on a regular basis, they’re effectively setting buyers up for churn. We know that a buyer who receives a 25-50% discount at the point of conversion has an ~11% higher likelihood to churn vs. the customer that did not receive a discount.

And even scarier, as the rate of discounting increases, the potential for renewals decreases.

By creating a culture of discounting, you’re training customers to expect more for less and moving further away from leading with product value.

Discounting may feel like a necessary evil in today’s economy, but there’s promising data to support flexing other gives/gets in the negotiation process. Before decreasing prices, consider offerings things like longer proof of concepts, shorter terms, more reference calls, or simply improving your business case.

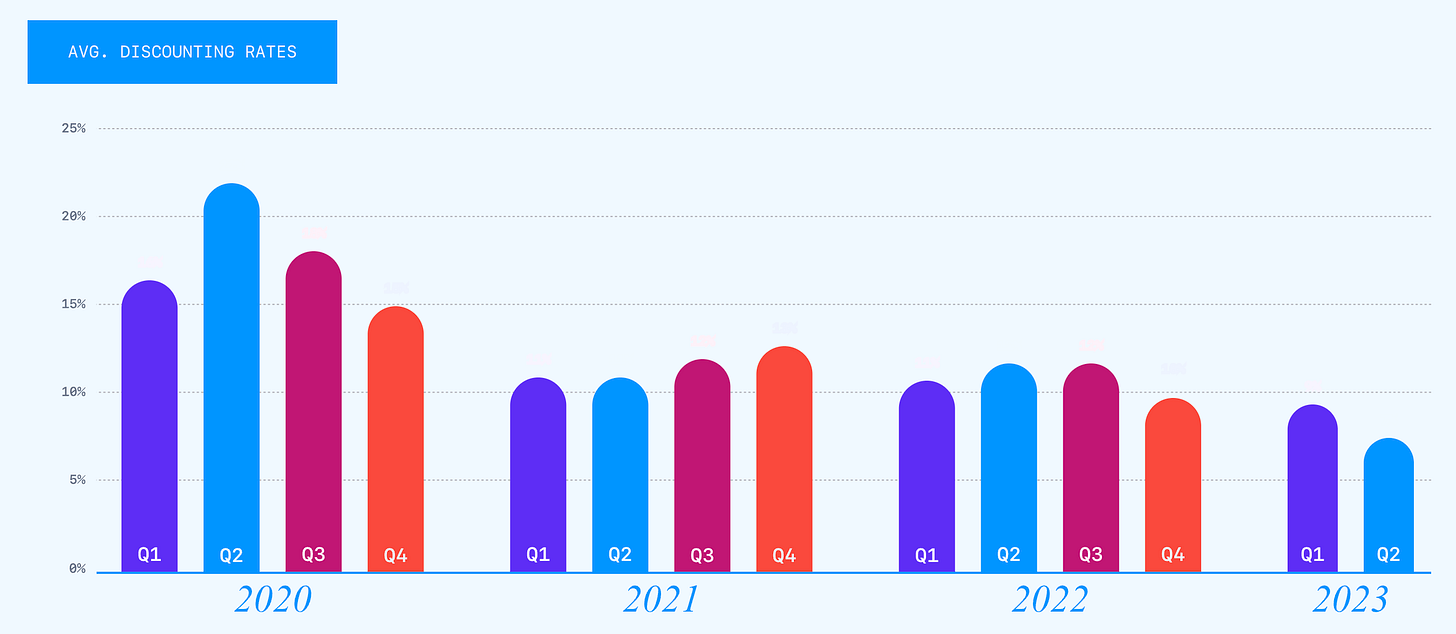

Vendr published a report last week that made me optimistic about discounting trends:

Despite what many of us think is happening, reps are actually discounting less than they have in the past few years.

Fix leaky buckets.

As our founder, Patrick Campbell, eloquently put it last October in reference to an impending recession:

Whoever ends with the most users, will win.

Retaining customers should be one of your top priorities today. And there are holes in the customer retention bucket that need some fixing.

One of the most prominent forms of churn comes from failed credit cards. Seriously.

Companies between $10m - $50m ARR see an average of 27.12% of churn coming from payment failures.

Optimizing this can be one of the most powerful decisions you make.

On the active churn front, many of us are perhaps too quick to assume the loss of customers without trying to win them back. You may want to consider things like salvage offers (i.e. discounts to keep folks around — again, I’m not advocating for discounting new customers but rather providing discounts to those on the brink of churning) and maintenance plans (e.g. “at a $5 /month fee, we’ll store all of your data for when you want to come back”).

And don’t forget about the power of reactivation campaigns. You have an opportunity to win back churned customers after 3, 6, 12 months. Launching reactivation campaigns to high-target customers is a great way to get folks who have seen the value of your product back in your funnel.

High Effort | High Impact

Strategic changes we’re seeing have a meaningful impact on profitability that also require cross-departmental buy-in and a heavier lift.

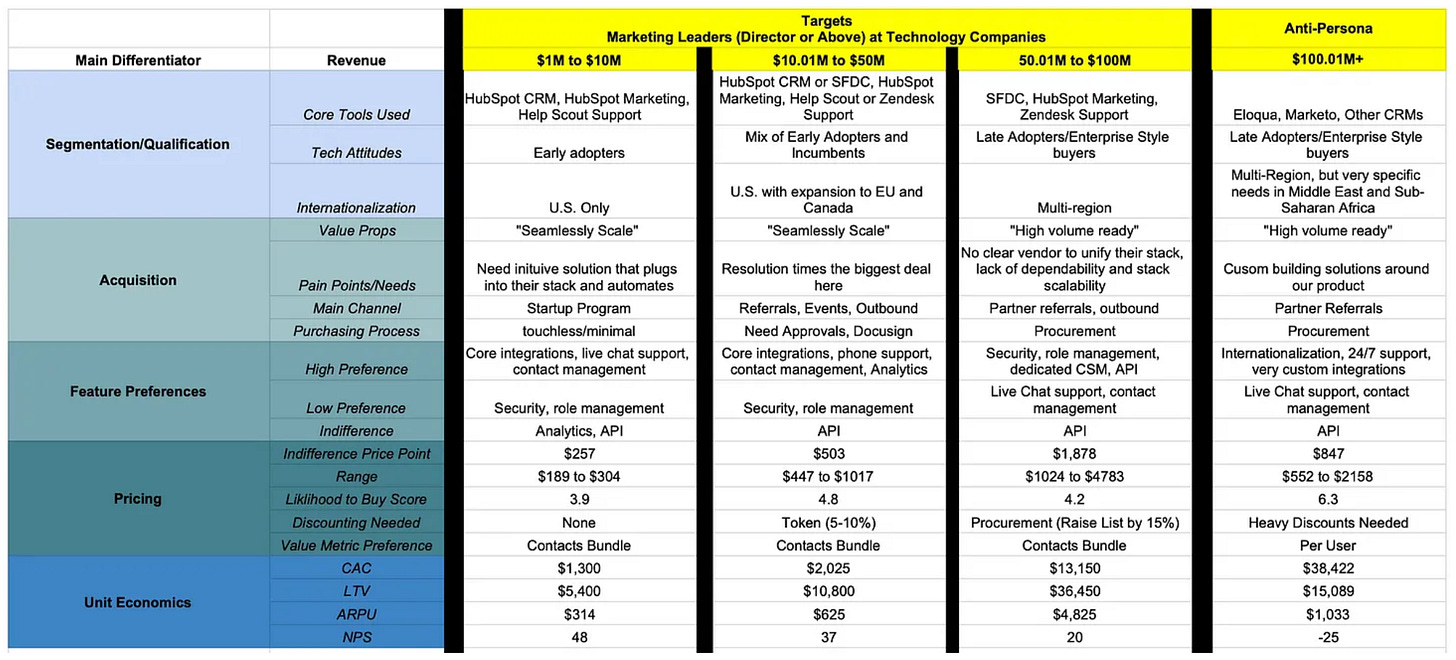

Rethink your buyer personas.

It’s no secret that your pricing strategy begins with identifying (and quantifying) your buyer personas. There was a time when a large part of my job was centered around educating early-stage operators on the pricing challenges associated with a lack of persona clarity. Those days have (thankfully) passed and now most of the folks I meet with are eager to share their buyers’ feature preferences, usage, and price sensitivity.

But there’s a small wrinkle in the buyer persona equation often left unanswered: which buyers will drive profitability?

The instinctive answer is “the upmarket buyer”, right? As you move upmarket, presumably you’ll see an increase in contract value, retention, and expansionary revenue while stabilizing the headaches associated with ankle biters (smaller deals, more support, etc).

We’re seeing this with folks like Drift, HubSpot, Airtable, and a host of others. Begin your journey as a PLG sweetheart, raise a few rounds of funding, and eventually pivot to the enterprise where the real money sits.

The problem with this playbook is the majority of SaaS companies don’t have the brand recognition or foundational support that Drift or HubSpot have and as a result, make errors in their move upmarket - i.e. discover technological constraints, misaligned value propositions, struggle to hire good sales reps, fumble over new commission structures, etc. On paper, total contract value goes up but margins suffer.

If moving upmarket isn’t a viable path forward, there’s a decent case for moving downmarket. Going all in on freemium, reverse trials, and land-and-expand strategies may actually be a more efficient path to profitability for some. Assuming you’ve found product-market fit, the grass may not be greener amongst the behemoths but rather in the self-serve lane where CFO/procurement involvement isn’t required for the sale of your product.

Whichever direction you choose, begin with a clear vision of your target personas. Here’s a template we put together to build strong, quantified personas:

Adjust your packages.

Once your personas are defined (or redefined), update your packages accordingly.

I’m letting you know again(!), some of the lowest-hanging fruit to boost expansionary revenue can be found within your packaging strategy.

Define your success metrics (e.g. free to paid, NDR, CAC:LTV, ARPU, etc) and use data to drive toward those outcomes. I’d start with historical usage data via your product analytics tool and map out feature usage by customer segments.

If you find features in core plans used by 20% or less of your audience, try selling them as add-ons.

Then move on to quantitative studies (using methodologies like conjoint, max diff, etc - I’ll unpack in a future week), where you can see preferred features cut by statistically relevant customer segments.

And last, layer in some qualitative interviews with current customers. Get on the phone and discuss why they bought vs. why they’ve stuck around (your buyers love you today for different reasons than they initially thought).

This should give you a good chance at optimizing your packaging strategy. And when done correctly, you’ll wish you’d done it three years ago.

Migrate existing customers onto new plans.

Most of you don’t want to hear this but your legacy pricing pact is hurting your business. Let’s quickly unpack a few things that happen when you don’t migrate your customers to newer pricing plans.

Most importantly, you’re missing out on additional revenue. Today, FP&A teams everywhere seem to be finding areas to cut costs in an effort to improve margins across the business. The flip side of this coin is, of course, finding additional revenue streams. And bumping customers onto updated plans is a path that will, for many, yield a significant impact on profitability.

This brings me to my next point:

By not moving customers onto updated pricing plans, you’re effectively training them to expect more for less.

If we agree that your price is the exchange rate on the value you’ve created, then your prices should continually match that value ascription of the products you’ve built.

However, if we take this one step further, your prices reflect the value you believe should be ascribed to your product and if you’re providing more value for a price point that doesn’t change, what message are you giving your customers?

Customer migration should not happen overnight. In fact, oftentimes, it will take you 6-18 months to fully complete. One of the best ways to accomplish this is by mapping out customers by cohorts, segmenting along churn-risk and revenue-uplift potential.

Once this is in place, devise your communication strategy. It may look something like this:

Month 0: Email announcement of pricing change to come. Public blog and/or social media post can follow.

Month 1-2: Email 1st cohort (determine cohorts by looking at least/most likely to churn indicators)

Month 3: Email 2nd cohort

Month 4: Email 3rd cohort

Month 8: Email 1st cohort – 4 months left

Month 9: Email 2nd cohort – 3 months left

Month 10: Email 3rd cohort – 2 months left

Month 11.5: Reminder to all cohorts – price will increase in 2 weeks

We’ll do a deeper dive into this concept in future weeks as it’s become apparent this is a necessary lever to pull for many companies. The line between customer satisfaction and increasing profitability is delicate, but when done correctly, will be one of the highest-yielding activities toward improving margins.

Recap

Profitability impacts valuation 3x more today than it did 18 months ago.

Monetization strategy has an outsized impact on profitability.

High Effort | High Impact strategies include: rethinking personas, adjusting packages, and migrating existing customers onto new plans.

Low Effort | High Impact strategies include: increasing or decreasing prices, avoiding discounts, and fixing leaky buckets associated with failed payments, salvage offers, and reactivations.

See you in 2 weeks!

-Evan

P.S. If you got value from this article, please share it!

Informative and insightful!